Lobotomy mythology

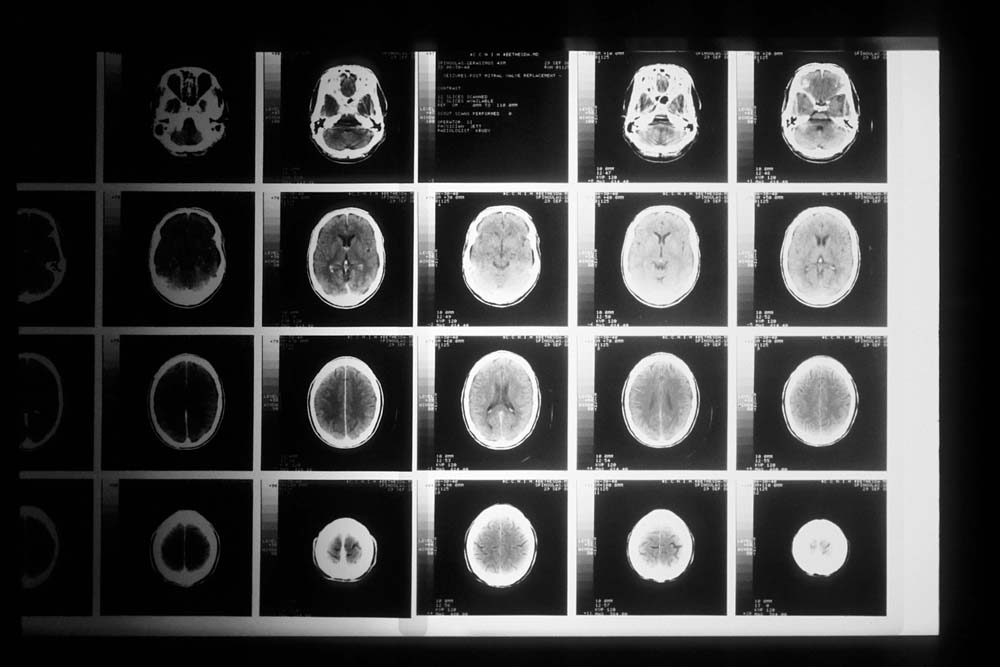

It’s hard to believe that lobotomies were once commonplace affairs. As Paul Offit recounts in Pandora’s Lab, Neurologist Antonio Egas Moniz and neurosurgeon Almeida Lima – after an afternoon of practice on a cadaver in 1935 – drilled holes into the skull of an insane asylum patient to mend her anxiety and paranoia. Their procedure, a self-proclaimed success, led to the proliferation of lobotomies around the world.

Lobotomized patients, however, experienced horrible side effects. This ranged from vomiting and diarrhea to nystagmus and kleptomania. Indeed, many experts realized early on that lobotomies were “pure cerebral mythology”. But its dangers escaped popular notice. It didn’t help that Moniz won the Nobel Prize in 1949 “for his discovery of the therapeutic value of leucotomy”. And media headlines like “No Worse Than Removing a Tooth” served only to boost its legitimacy in the public’s mind.

Today, lobotomy sounds downright macabre. But it’s not hard to understand why it remained popular for so long. As Offit points out, many mental health disorders, like schizophrenia, are debilitating and difficult to treat. Lobotomies offered hope and a quick-fix to desperate patients and families. The results, of course, didn’t go to plan.

Pauling’s sandcastles

Indeed, lobotomies serve as a reminder of science gone wrong. In our search for solutions, we accept dangerous procedures that we do not yet fully understand. It is, however, far from the only example. Offit tells a similar story with the complicated legacy of the brilliant chemist, Linus Pauling.

Today, we remember Pauling as the founder of quantum chemistry and molecular biology. He was a titan of progress, winning the Nobel Prize twice. One for chemistry in 1954 “for his research into the nature of the chemical bond and its application to the elucidation of the structure of complex substances”. And another for peace in 1962, “for his fight against the nuclear arms race between East and West”.

Extraordinary claims

Later in his career, however, Pauling focused on dietary supplements and vitamin therapy. And in his bestseller Vitamin C and the Common Cold, Pauling “urged Americans to take … roughly 500 times the recommended daily allowance [of vitamin C]” – claiming “that vitamin C also cured cancer”.

Several controlled trials, however, didn’t support of Pauling’s assertions. One might then expect Pauling to collate more research and evidence to defend his position. Carl Sagan reminds us, after all, that “extraordinary claims demand extraordinary evidence”.

But Pauling wouldn’t or couldn’t accept the evidence mounting against him. He instead accused detractors of “deliberate fraud and misrepresentation”. Pauling “had been so right for so long”, Offit says, “that he just couldn’t imagine that he could ever be wrong”. It was hubris born from brilliance.

Unfortunately, these studies did little to tamper the market’s enthusiasm. Many continue to view supplements as an affordable, convenient fix to every bodily woe. They assume that all pills are equal in their efficacy and evidence-base; and allow word-of-mouth and social fads to guide their habits. In Offit’s view, Pauling’s reputation, media appeal, and advocacy, “gave birth to a vitamin and supplement industry built on sand”.

The Nobel disease

Moniz and Pauling are examples of what some call the Nobel Disease. From time to time, a Nobel laureate, with plenty of prestige, goodwill, and confidence, go on to spread a new movement before the necessary scientific validation is complete.

Offit points to Luc Montagnier as another example. Following his receipt of the Nobel Prize in 2008 for the discovery of HIV, Montagnier went on to promote antibiotics as a cure for autism without substantive evidence. Montagnier and Pauling “were convincing”, Offit says, “because they wore the badge of academic success, not because they had reproducible data showing that they were right”.

“[If] Linus Pauling’s hypotheses were right, then subsequent studies would have shown that they were right. … The minute that you hear researchers claim conspiracy, you should suspect that their hypotheses are built on sand. … The lesson in the Linus Pauling story can be found in the movie The Wizard of Oz: Pay attention to the little man behind the curtain. … The same applies to science: Don’t be blinded by reputation. Every claim, independent of a scientist’s reputation, should stand on a mountain of evidence. No one should get a free pass.”

Paul Offit. (2017). Pandora’s Lab: Seven Stories of Science Gone Wrong.

Scholes and Merton’s mismanagement

Offit’s case studies remind me of another in finance: the rise and fall of hedge fund Long-Term Capital Management (LTCM). Niall Ferguson recounts the drama in the Ascent of Money, which begins in 1993 when Myron Scholes and Fisher Black, based on earlier work by Robert Merton, developed an equation to price option contracts. Many finance students know it today as the famous Black-Scholes model. In fact, both Merton and Scholes went on to win the 1997 Nobel Prize in Economics for their “pioneering formula”.

The dream-team

In 1994, Merton and Scholes joined John Meriwether – a former star at investment bank Saloman Brothers – to create LTCM. Alongside them were David Mullins (former Federal Reserve vice-chairman), Eric Rosenfeld (Harvard business professor), and several ex-Salomon traders. Enthused bankers and investors believed they had found their dream team.

To generate returns, LTCM used a convergence trading strategy to exploit pricing anomalies across bonds, swaps, options, and other financial markets. There was, as always, a catch. They relied on enormous leverage. By late 1997, LTCM boasted an asset-to-capital ratio of 19-to-1, and “debt-financed assets … [amounting] to $126.4 billion”.

The geniuses at LTCM, however, didn’t see their indebtedness as a problem. Their quantitative models told them that “there was next to no risk involved”. LTCM had advertised themselves as “a market neutral fund”. And given their “dynamic hedging” strategy, they were supposedly immune to unfavorable market movements.

What’s more, they were generating annual returns fees in excess of 40 percent in their second and third year of operations. And Scholes and Merton’s Nobel Prize in 1997 added only to LTCM’s glowing reputation. People believed the dream team had cracked the financial code.

Hubris to meltdown

Yet, just a few months later, perhaps with some irony, LTCM unraveled. When Russia’s financial system imploded in 1998, market volatility skyrocketed to levels thought near impossible by LTCM’s mathematical models. What LTCM believed to be uncorrelated exposures began to co-move together.

As Ferguson recounts: “in quant-speak, the correlations had gone to one”. “Long-Term was down 44 percent” for “a total loss of $1.8 billion”. This spelled the beginning of LTCM’s end. To avoid greater financial contagion and market collapse, the Federal Reserve Bank of New York had to engineer a $3.6 billion bailout. Many investors, like the University of Pittsburgh, saw their holdings in LTCM evaporate.

Where did they LTCM go wrong? Ferguson says the assumptions that underpinned LTCM’s strategies relied on the efficiency of markets (that price levels will correct over time). LTCM neglected how international events can reverberate across the system; and the old adage: “markets can remain irrational longer than you can remain solvent”. Paralyzed markets stranded the indebted hedge fund with an enormous pool of illiquid assets.

As egregiously, LTCM’s models “were working with just five years’ worth of data”. Had their models gone further back, they would know that periods of extreme volatility do happen. “To put it bluntly”, Ferguson says, “the Nobel Prize winners had known plenty of mathematics, but not enough history”.

Financial amnesia appears doubly true for investors and regulators. Just one year after LTCM’s collapse, Meriwether raised $250 million to start a second hedge fund. It folded a decade later during the Global Financial Crisis. Not a problem, right? Meriwether simply launched a third fund in 2010.

Thick curtains and winning personalities

The Nobel disease, of course, is not confined to Nobel Prize winners. It is an illustration of fallibility and hubris. Even the brightest minds make mistakes, sometimes of monumental proportions. And while reputations are usually reliable heuristics, they are vulnerable to exploitation and misdirection. Elizabeth Holmes, for example, cultivated influential board directors to strengthen her deception at Theranos. Bernie Madoff’s reputation, likewise, as the former chair of NASDAQ, kick-started Madoff Securities – the largest Ponzi scheme in history. Offit reminds us to “pay attention to the little man behind the curtain”. We cannot allow their “winning personalities [to] hide their lack of evidence”. The Nobel disease in science and finance is a dark reminder of that.

Sources and further reading

- Offit, Paul. (2017). Pandora’s Lab: Seven Stories of Science Gone Wrong.

- Ferguson, Niall. (2008). The Ascent of Money: A Financial History of the World.

Recent posts

- The Trusted Advisor — David Maister on Credibility and Self-Orientation

- How We Learn — Stanislas Dehaene on Education and the Brain

- Catching the Big Fish — David Lynch on Creativity and Cinema

- Donald Murray on the Apprentice Mindset and Return to Discovery

- The Hidden Half — Michael Blastland on the Unexpected Anomalies of Life

- Artificial Intelligence — Melanie Mitchell on Thinking Machines and Flexible Humans

- Fallibility and Organization — J. Stiglitz and R. Sah on Hierarchies and Polyarchies

- The Art of Statistics — David Spiegelhalter on Reasoning with Data and Models